SwapAgent

Clearing efficiencies for non-cleared OTC derivatives

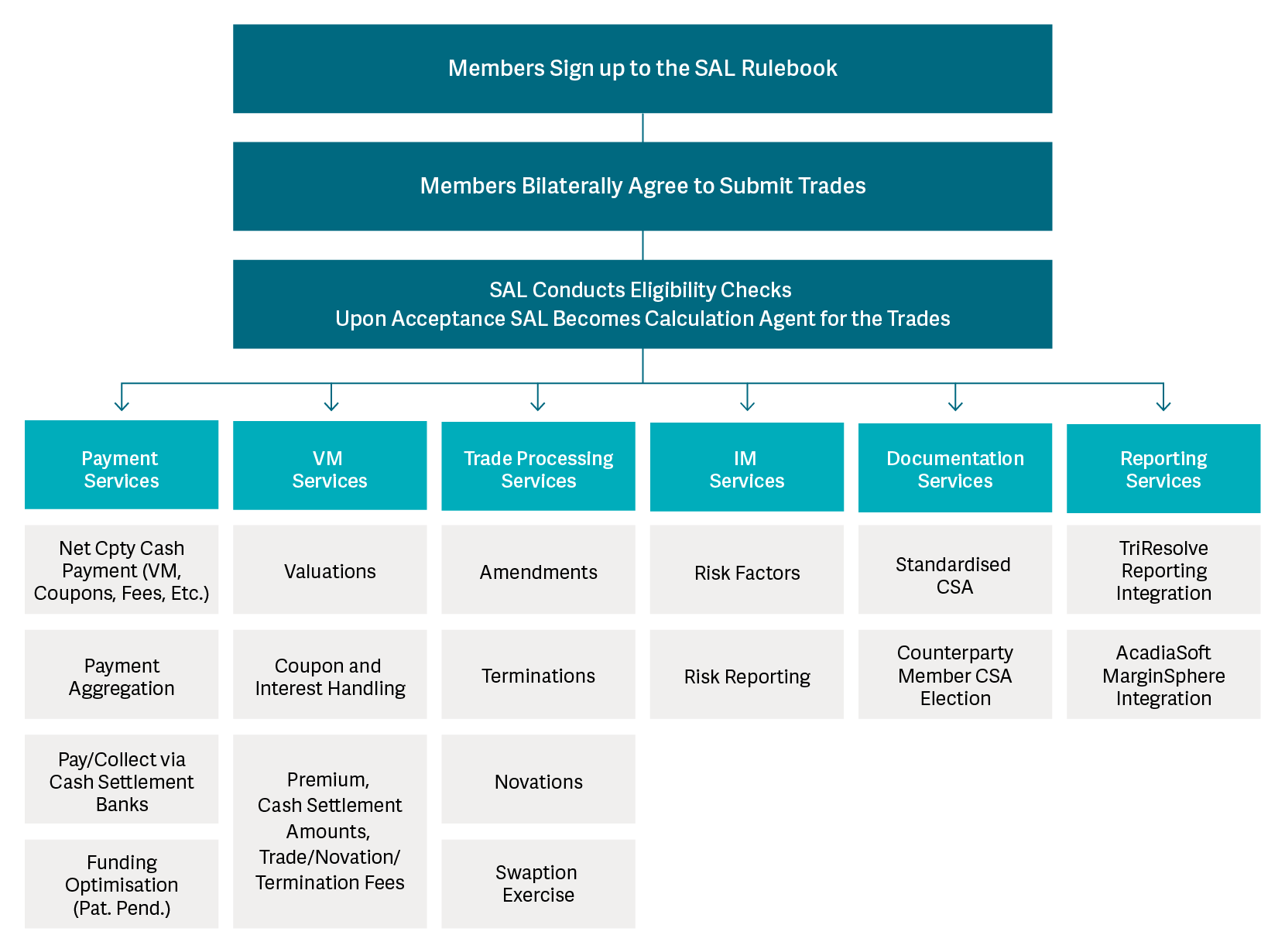

SwapAgent is a service designed to simplify the processing, margining and settlement of non-cleared derivatives. SwapAgent benefits from LCH’s expertise in serving and managing risk for the cleared rates and FX derivatives market, providing market participants with a number of solutions designed to materially improve standardisation, efficiency and simplicity in the non-cleared derivatives market.

SwapAgent provides these solutions by extending the clearing infrastructure to the bilateral market without requiring novation to a central counterparty. So while trades managed by SwapAgent remain fully bilateral, they follow a similar operational process as cleared trades, including centralised trade processing, valuation, margining, risk calculation and optimisation services.

That way LCH can extend many of the efficiencies that customers have become accustomed to in the cleared market to the non-cleared market.

SwapAgent improves standardisation, efficiency and simplicity in the bilateral derivatives market through:

- Standardisation of collateralisation document terms

- Uniform end-to-end trade processing and life cycle management

- Independent valuation and dispute elimination for SwapAgent trades

- Standardised risk factor calculations for bilateral initial margin calculations

- Simplification and standardisation of the collateralisation and settlement process

- Elimination of unnecessary payment flows (e.g. netting coupons and variation margin)

- Increased ability to move trades between counterparties and to the clearing house without funding impacts driven by collateralisation term

| Category | Bilateral SwapAgent | Bilateral Today |

SwapClear |

|---|---|---|---|

| Standardised Collateral Documentation | ✓ | x | ✓ |

| Standardised Trade Processing | ✓ | x | ✓ |

| Independent Valuation Agent | ✓ | x | ✓ |

| Dispute Elimination | ✓ | x | ✓ |

| VM/Coupon/Interest Netting | ✓ | x | ✓ |

| Standardised Risk Factor Calculation | ✓ | x | ✓ |

| Standardised Payment Processing | ✓ | x | ✓ |

| Cross-Currency and Swaptions | ✓ | ✓ |

x |

| Central Counterparty | x | x | ✓ |

| Default Fund | x | x | ✓ |

Compression alone at LCH has already reduced notional outstanding for cleared derivatives by more than $200 trillion, saving an estimated $25 billion in capital for the industry. By introducing opportunities such as this to the bilateral market, we are improving its sustainability.*

*Data provided by Group Operations

SwapAgent service benefits from the infrastructure of SwapClear, which this year has already reduced notional outstanding for cleared interest rate swaps by nearly 50% with its compression optimisation services. That’s over $363 trillion in real notional reduction and an estimated $24 billion or more in capital savings for the industry.*

Because we’ve already built and proven the benefits of cleared swaps, we believe we can extend many of these efficiencies to the non-cleared market.

*Data provided by Group Operations

SAL = SwapAgent Limited

SwapAgent streamlines and standardises collateral documentation. We do this by introducing a service under which participants agree that standard collateralisation terms apply for trades submitted to SwapAgent.

We will introduce a new rulebook to cover this, similar in many ways to the existing clearing rulebook. Once a member signs up, trades submitted through SwapAgent are bound by its terms, including standardised amendments to existing collateralisation documentation, which members can choose to apply to their bilateral SwapAgent trades.

It’s really straightforward to take advantage of SwapAgent.