Risk Management

Built upon LCH’s proven risk management, you’re in safe hands at CDSClear.

Risk management lies at the core of everything we do here at CDSClear.

Our Clearing Members and their clients benefit from more than 100 years of LCH experience in managing and mitigating risk for our market partners.

Many of the protections and safeguards that counterparties enjoy at CDSClear have been developed, enhanced and refined through our hard-won practical clearing experience at LCH.

These protections include:

A resilient margin model

Based on historical simulations with scaled returns. CDSClear employs the same margin methodology as SwapClear, which successfully resolved the 2008 default of Lehman Brothers with no cost impact on fellow interest rate swap Clearing Members

Expected shortfall

Initial margin calculated under the expected shortfall methodology to a 5-day confidence interval of 99.7%

Look back period

That extends back to April 2007 with constant start date

Holding period

5-day holding period for house positions; 7-day holding period for client positions

Default fund

A mutualised CDS default fund requiring a €10 million minimum Clearing Member contribution in Euro cash only

Portfolio margining

Cross margining benefits across CDS indices and single names

Margin simulation services

Enabling members and clients to calculate collateral requirements prior to clearing

Skin in the game

€20 million LCH SA's Contribution - 1st layer of Skin in the Game

Variable Contribution from LCH SA - 2nd layer of Skin in the Game

At CDSClear we accept both cash and a broad range of government securities as eligible collateral that can be posted as initial margin to secure your cleared CDS positions.

Margin is calculated and posted every day for all new positions.

Variation margin is collected daily and must be met in cash.

Posting cash margin

Euro

Clearing Members must deposit Euro cash collateral via an account held within a central bank connected to the TARGET 2 system or be represented by a payment agent holding such an account.

Daily cap for Euro cash collateral deposit:

-Euro cash deposited after the first intraday slot will be subject to a €1 billion cap per CDS Clearing Member.

- Euro cash deposited after 16.30 CET will be subject to a €50 million cap per CDS Clearing Member

Any change on the cap amount will be communicated in advance.

US Dollar or British Pound

Clearing Members must deposit US Dollars or British Pounds cash collateral via an account in the name of LCH within the commercial bank Euroclear Bank.

FCM Clearing Members must deposit US dollars cash collateral via an account in the name of LCH within the commercial bank Bank of New York Mellon.

US Dollar cash collateral is subject to a 4.8% haircut. British Pound cash collateral is subject to a 5.4% haircut.

Posting securities as margin

CDSClear currently allows Members to post securities as collateral issued by twelve Sovereign Governments as well as a selection of Supranationals and Agencies. Securities must be deposited either via Full Title Transfer accounts opened by LCH SA at various Central Securities Depositories (CSDs) or via Pledge whereby eligible collateral will be deposited via a Single Pledgor pledged Account (SPPA) opened by LCH SA at Euroclear Bank.

CDSClear also offers triparty collateral services via Euroclear as the triparty agent.

Collateral segregation

Clearing Members and clients clearing at CDSClear have access to the full suite of collateral segregation models available under the European and US legal frameworks.

Segregated Accounts under EMIR

Individual Segregated Account (ISA): Client trades, positions and assets fully segregated from all other customer positions

Net Omnibus Segregated Account (Net OSA): Client trades segregated from each other. Margins are calculated net across all individual clients’ exposure.

Clients are exposed to positions held by other clients within the Net OSA

Gross Omnibus Segregated Account (Gross OSA): Client trades segregated, margin can be segregated or netted as client wishes. Accounts are exposed to potential loss mutualisation following depreciation of collateral tagged for the Gross OSA

Segregated Accounts under the Dodd-Frank Act

LSOC without excess (FCM model): Trade accounts and margins calculated individually for each client in segregated accounts. Clients have protection over the value of collateral recorded as their Legally Segregated Value. Clients are exposed to potential loss mutualisation following depreciation of collateral.

CDSClear Margin Methodology

LCH's robust risk management framework – underpinned by a team of over 50 dedicated risk managers – affords clearing members exceptional levels of protection.

At CDSClear, initial and variation margin is collected from our members and their clients. In the event that they should fail, this margin is used to fulfil their obligations.

The amount of margin is decided by the CDSClear risk management team, who assess a member's positions and market risk on a daily basis.

The technical components of the margin requirement calculated for CDSClear Clearing Members are set out in Chapter 2 of Title IV of the CDS Clearing Rule Book and are further described in Section 2 of the CDS Clearing Procedures.

In addition, Section 6 of the CDS Clearing Procedures provides a detailed description regarding the method for calculating each Clearing Member's contribution to the CDS default fund.

Default Management

In the event of a Clearing Member insolvency, CDSClear has a tried-and-tested four step default management process to ensure the smooth resolution of the failure while minimising any impact from the default on surviving Clearing Members and their clients.

Client porting

After a Member defaults, CDSClear immediately begins porting non-defaulting clients to solvent Clearing Members. Clients will be ported to an alternative Clearing Member – if their segregation account structure allows – within 48 hours of the failure of their original clearing broker.

Hedging phase

Alongside client porting, we hedge the defaulted Clearing Member’s trade portfolio with the assistance of our Default Management Group (DMG), including a group of senior CDS traders from the major credit derivatives market makers that are seconded to LCH in the event of default.

Portfolio auction

Portfolio auction - Once the risk of the defaulter’s portfolio is substantially reduced by the DMG, CDSClear separates the defaulter’s portfolio as advised by the Default Management Group (DMG). An auction is then conducted for each portfolio. Bidding in the auction is mandatory for surviving Clearing Members subject to certain conditions applicable to certain categories of membership with non-bidder’s juniorised in the default waterfall.

Loss attribution

In the event that losses are greater than the financial resources of the defaulting member and of LCH, the funded default fund contributions of solvent CDSClear members are used.

CDSClear’s Default Waterfall

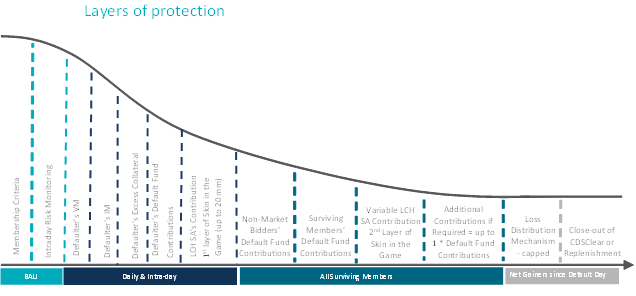

Below is a graphic representation of CDSClear’s Default Waterfall.

Moving from left to right, you can see the various safeguards that make up the waterfall, from the first layer of protection – stringent membership criteria to ensure only well-qualified and strongly-resourced counterparties are admitted as Clearing Members – through to the consumption of the defaulting party’s resources as its failure is resolved.

At least seven tiers of security – including five distinct layers of financial resources - are required to be breached before non-defaulting Clearing Members begin to experience losses arising from the insolvency of a fellow member.